Expat Investment Advice: Is Risk Aversion Threatening Your Retirement Plan?

By Chad Creveling, CFA and Peggy Creveling, CFA

Most expatriates who expect to retire on their savings need to invest a reasonable portion of their money in higher-risk (more volatile) asset classes such as stocks or equities. This is because most of us simply won't be able to save enough in low-risk, low-return assets to fully cover our retirement expenses plus inflation. However, in some cases investors may be getting it backwards. When market volatility picks up, some are tempted to sell their equity holdings and moving their savings into the perceived safety of low-volatility, but also low expected return investments such as bonds, fixed deposits, or cash.

Expat investors generally understand that higher-risk investments such as equities also come with a higher probability of achieving greater long-term returns. Yet on a day-to-day basis, the media is full of stories of the potential negative consequences of fragile or negative global economic growth, increased chance of recession, debt ceilings, and fiscal cliffs. With so much daily uncertainty, it can be hard to focus on the long term. It's not surprising that investors hunker down and try and try to play it safe, even if that means they will have a reduced chance of funding retirement or other long-term goals. To illustrate this point, consider the following behavioral finance study conducted by researchers at UCLA and the University of Chicago.

Study: Risk Aversion or Myopia?

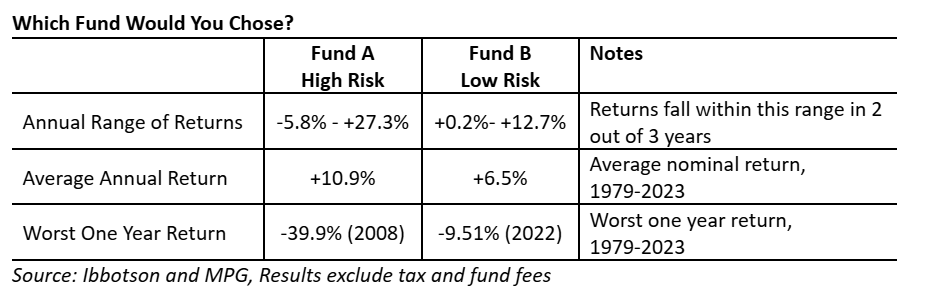

In a classic behavioral finance study conducted by professors Shlomo Benartzi and Richard Thaler, people investing for retirement were shown historic information regarding one-year returns for two funds. One fund was high-risk (Fund A, invested in stocks), and one was low-risk (Fund B, invested in bonds). Based on this information, study participants were then asked how much of their retirement savings they would choose to invest in each fund.

Over a one-year period, the likelihood of stocks underperforming bonds is about a third. However, focusing on worst one-year returns, average one-year risk (short-term volatility) and return information, increased the perceived risk of investing in stocks while lowering study participants' willingness to do so. This was the case not just for one-year periods, but also for the long term. The study group that viewed one-year return information ended up choosing an average allocation for their retirement portfolios that was only 40% in Fund A (stocks) and 60% in Fund B (bonds).

By contrast, the researchers showed a separate group of retirement investors a distribution of long-term (30-year) returns for the same two funds. The group that saw the 30-year return distribution allocated their portfolios much more aggressively than the group that saw the one-year return information. The group that saw the 30-year return distribution chose to put 90% of their retirement portfolio in Fund A (stocks) and only 10% in Fund B (bonds).

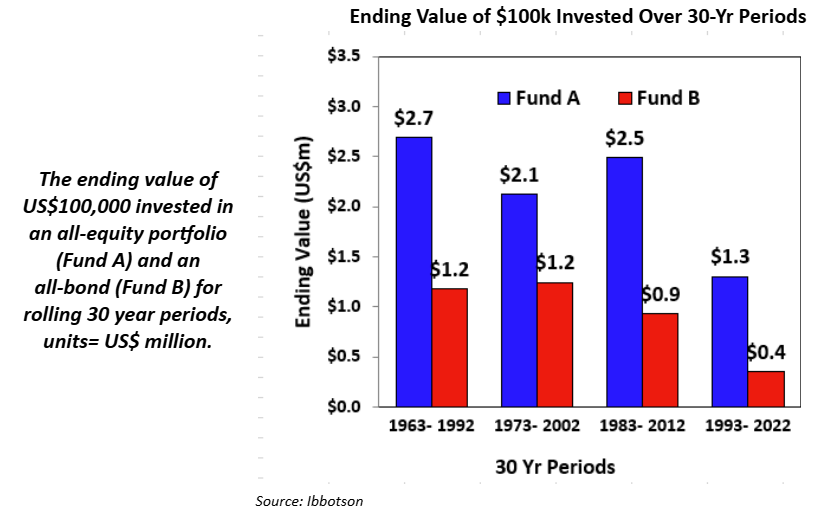

Academics estimate that the likelihood of stocks underperforming bonds over a 30-year period to be only about 5%. The following actual return figures would seem to bear this out, as equities outperformed bonds by a wide margin in the following 30-year sample periods:

What We Can Learn

Focusing on the wrong benchmarks can result in sub-optimal decision-making. Practically speaking, this means it's best to not focus on what your retirement portfolio has done on a day-to-day, week-to-week, or month-to-month basis. Even one-year performance figures don't mean much when compared to the true long term (30 years or more-basically, the rest of your life). If you've successfully allocated your retirement portfolio for the long run and included a reasonable amount of equity in the mix, remember that short-term fluctuations are normal and should be expected. By keeping the long-term picture in mind, you'll be able to resist the urge to invest only in fixed income. Instead, make sure that you have some equity in your retirement portfolio.

This article is a revised and updated version of one that has appeared previously on www.crevelingandcreveling.com .

Additional Resources

- Expat Investment Advice: Tips for Dealing with Market Volatility

- Expat Investment Advice: Seven Things Expats Need to Know About Investing

- Expat Case Study: Overcoming the Cycle of Greed and Fear in Investing

About Creveling & Creveling Private Wealth Advisory

Creveling & Creveling is a private wealth advisory firm specializing in helping expatriates living in Thailand and throughout Southeast Asia build and preserve their wealth. The firm is a Registered Investment Adviser with the U.S. SEC and is licensed and regulated by the Thai SEC. Through a unique, integrated consulting approach, Creveling & Creveling is dedicated to helping clients cut through the financial intricacies of expat life, make better decisions with their money, and take the steps necessary to provide a more secure future.

Copyright © 2024 Creveling & Creveling Private Wealth Advisory, All rights reserved. The articles and writings are not recommendations or solicitations, and guest articles express the opinion of the author; which may or may not reflect the views of Creveling & Creveling.